Debt Consultant with EDUdebt Singapore: Personalized Debt Alleviation Program

Debt Consultant with EDUdebt Singapore: Personalized Debt Alleviation Program

Blog Article

Explore the Comprehensive Solutions Used by Financial Obligation Specialist Services to Assist Family Members and individuals Attain Financial debt Recuperation Success

The monetary landscape for family members and individuals grappling with debt can be complicated, yet financial debt professional services offer a structured strategy to navigate this complexity. By using customized economic assessments, customized budgeting approaches, and adept lender negotiation methods, these solutions provide to special circumstances and obstacles. Additionally, clients gain from continuous support and educational resources that empower them to maintain long-term economic wellness. As we check out the intricate services provided by these consultants, it comes to be necessary to consider just how they can change a difficult monetary situation into a convenient recovery strategy.

Comprehending Financial Debt Consultant Services

Financial debt professional solutions play an important function in aiding services and people navigate the complexities of financial obligations. These solutions offer skilled guidance and assistance customized to the one-of-a-kind financial circumstances of clients. By assessing the overall economic landscape, financial debt professionals can determine the underlying problems adding to debt accumulation, such as high-interest prices, inadequate budgeting, or unforeseen expenditures.

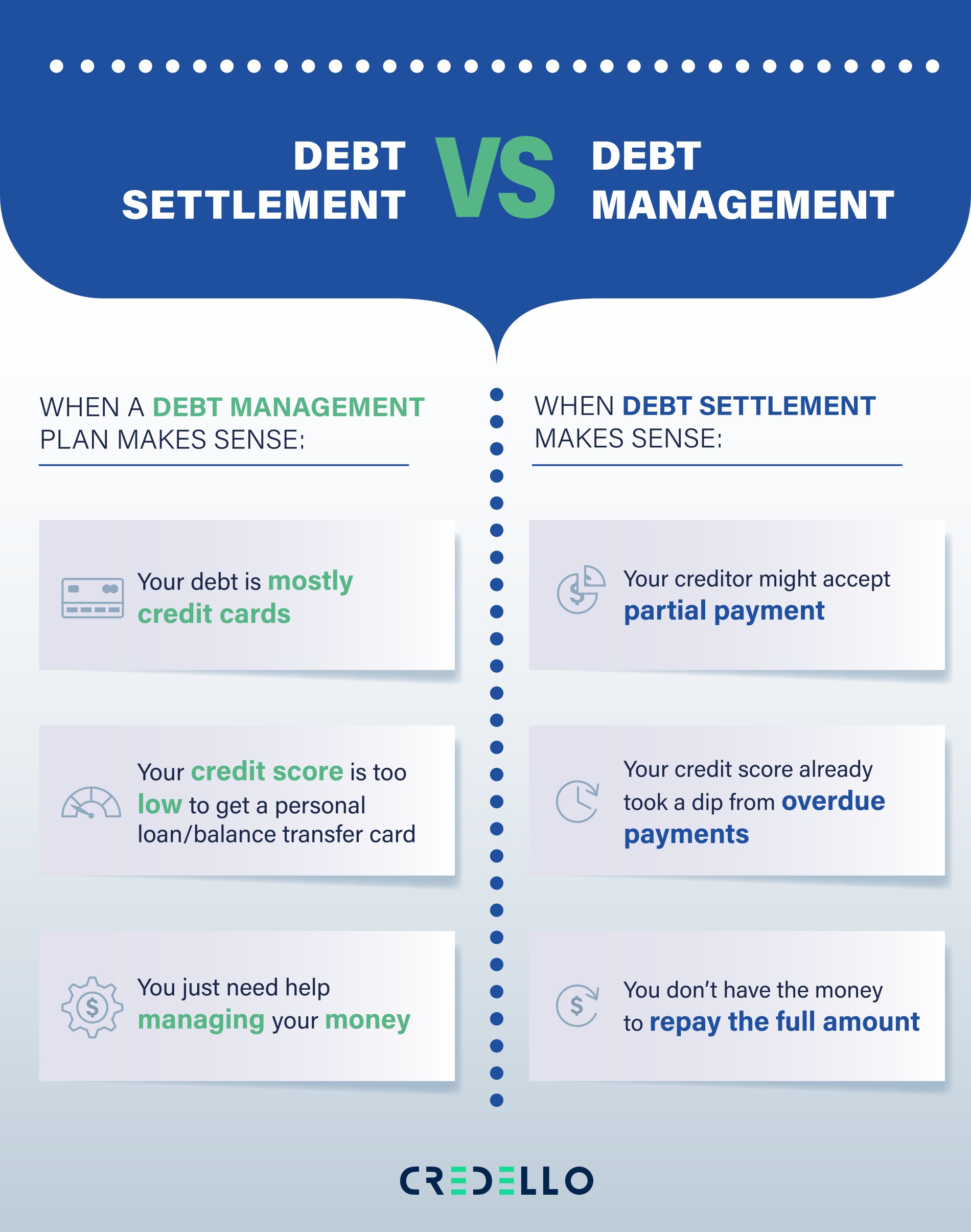

A key function of debt specialists is to enlighten clients about their choices for handling and lowering financial debt. This might involve discussing with financial institutions to secure a lot more desirable terms or discovering debt loan consolidation strategies to streamline payments. In addition, professionals encourage customers with the expertise necessary to make enlightened financial decisions, fostering a much deeper understanding of financial debt management principles.

The competence offered by financial debt professionals expands beyond mere financial debt decrease; they additionally play an important duty in establishing lasting economic methods. By instilling technique and advertising accountable investing behaviors, these professionals help clients develop a strong structure for future economic stability. Eventually, debt consultant solutions work as a crucial source for people and companies looking for to gain back control over their financial health and wellness and achieve long lasting financial obligation recovery success.

Personalized Financial Evaluations

A thorough understanding of a customer's economic situation is fundamental to effective financial debt monitoring, and individualized monetary analyses are at the core of this procedure (contact us now). These analyses supply a comprehensive review of an individual's or household's economic landscape, including income, liabilities, costs, and properties. By examining these important aspects, financial obligation specialists can identify the special challenges and chances that each client encounters

Throughout a personalized economic assessment, specialists involve in detailed conversations with clients to collect significant information regarding their economic behaviors, goals, and issues. This information is then examined to create a clear picture of the client's existing economic health. The process often involves assessing costs practices, recognizing unneeded expenses, and figuring out the impact of existing financial obligations on general monetary stability.

Moreover, customized economic analyses allow professionals to determine potential areas for enhancement and establish sensible financial goals. By tailoring their method per customer's particular situations, financial obligation consultants can develop workable approaches that line up with the customer's desires. Inevitably, these analyses work as an essential beginning point for effective debt recovery, preparing for educated decision-making and lasting financial administration.

Custom-made Budgeting Strategies

Effective economic management joints on the implementation of personalized budgeting techniques that accommodate individual demands and scenarios. These approaches are essential for households and people aiming to restore control over their monetary situations. A one-size-fits-all approach usually fails, as everyone's economic landscape is one-of-a-kind, affected by earnings, expenses, debts, and personal objectives.

Financial debt professional solutions play a crucial function in establishing customized budgeting strategies. At first, specialists carry out thorough evaluations to identify revenue resources and categorize expenses, comparing discretionary and vital costs. This enables clients to identify locations where they can decrease expenses and allocate more funds towards debt settlement.

In enhancement, customized budgeting approaches incorporate reasonable monetary goals, assisting clients set attainable targets. These objectives promote a feeling of responsibility and inspiration, essential for maintaining dedication to the spending plan. Continuous assistance and periodic testimonials ensure that the budgeting approach continues to be appropriate, adapting to any kind of adjustments in economic circumstances or personal concerns.

Ultimately, personalized budgeting strategies empower families and people to take aggressive actions toward financial debt recovery, laying a strong structure for long-lasting financial security and success.

Financial Institution Arrangement Strategies

Discussing with lenders can significantly minimize monetary problems and lead the way for even more manageable repayment plans. Effective financial institution negotiation methods can encourage households and people to accomplish considerable financial obligation relief without resorting to personal bankruptcy.

One essential strategy is to plainly comprehend the economic situation before initiating contact. This consists of gathering all appropriate information about financial obligations, rate of interest, and payment backgrounds. With this information, the borrower can provide an engaging situation for negotiation, highlighting their readiness to pay off while stressing the obstacles they face.

An additional method includes recommending a practical payment strategy. Using a lump-sum repayment for a reduced total balance can be appealing to financial institutions. Additionally, recommending reduced regular monthly repayments with extended terms may help alleviate capital issues.

Furthermore, maintaining a considerate and tranquil disposition throughout arrangements can cultivate a participating environment. When come close to with professionalism and reliability and politeness., financial institutions are a lot more likely to think about proposals.

Continuous Assistance and Resources

Continuous assistance and resources play a critical role in helping people browse their monetary recovery trip post-negotiation. After efficiently discussing with creditors, customers often need additional support to preserve their newly recovered monetary security. Financial obligation consultant solutions offer constant support via different opportunities, guaranteeing that individuals remain on the right track towards attaining their economic objectives.

In addition, several debt specialists dig this supply customized follow-up examinations, enabling customers to obtain and go over ongoing obstacles customized advice. This ongoing connection assists clients stay responsible and motivated as they function in review the direction of lasting economic recuperation.

Moreover, access to online devices and resources, such as budgeting apps and credit score surveillance solutions, boosts clients' capability to handle their finances effectively - contact us now. By combining education and learning, individualized assistance, and practical devices, debt consultant services empower individuals and families to achieve and sustain enduring economic healing

Conclusion

Via personalized financial evaluations, customized budgeting strategies, and expert creditor negotiation strategies, these solutions effectively attend to unique financial difficulties. The extensive remedies used by debt experts inevitably foster economic security and accountable costs routines, paving the way for a more protected financial future.

Report this page